FTA Login: Federal Tax authority is an organ of government in the UAE. It’s main function is to collect taxes. As responsible citizens, we often pay our taxes. But the government initiated a program to facilitate us paying our taxes through a single website, which helps us not even go to the tax office center or stand in long lines to pay our taxes.

FTA website provides this facility to all citizens in the UAE. There may be different form of taxes that we pay to our government and all these taxes can be paid through a single website. You just need to have an FTA login to perform your taxes. In this article, we delve into the details that involve performing tax through a website.

How To Access FTA Login Service

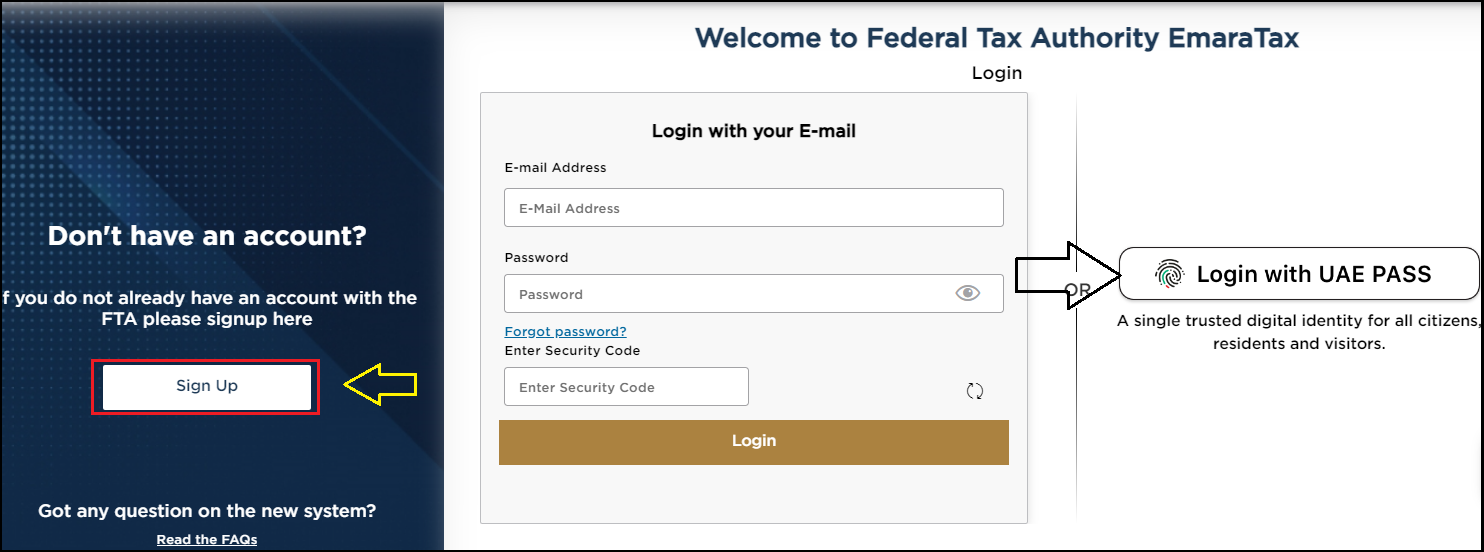

It’s very simple to access the FTA login, or its other name, EmaraTax, which is a UAE-based tax collection site. If you have UAE pass, then you can easily login with FTA. The other way to login to FTA is to sign up through your Gmail or mobile number. Through this process, you have to verify the OTP that was sent to your email. After verification, you can go through the next stage.

FTA Sign-Up Process

If you don’t already have a login, then you have two options: one is to login with your UAE pass. If you don’t have a UAE Pass, follow these procedures to sign up.

- Visit the official site: https://eservices.tax.gov.ae/

- Click on the left-side corner sign-up button

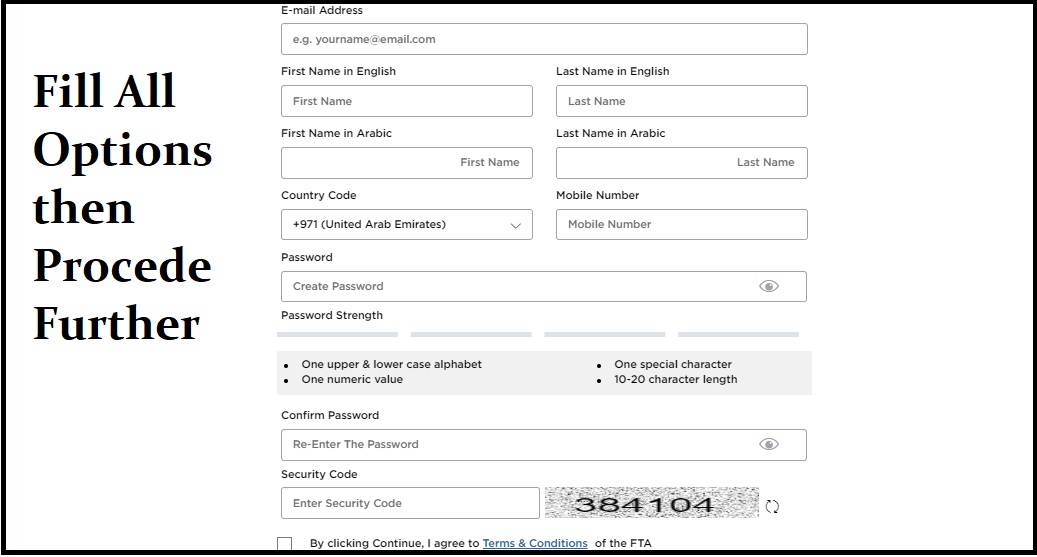

- When you click it, it shows a sign-up Form

- Fill out the sign-up form, which requires you to enter your email address, first name, last name, both in English and Arabic, and your phone number. Create a password and check the security code there.

- An OTP will be sent to your email to confirm the code

- After code confirmation, you have access to the FTA site.

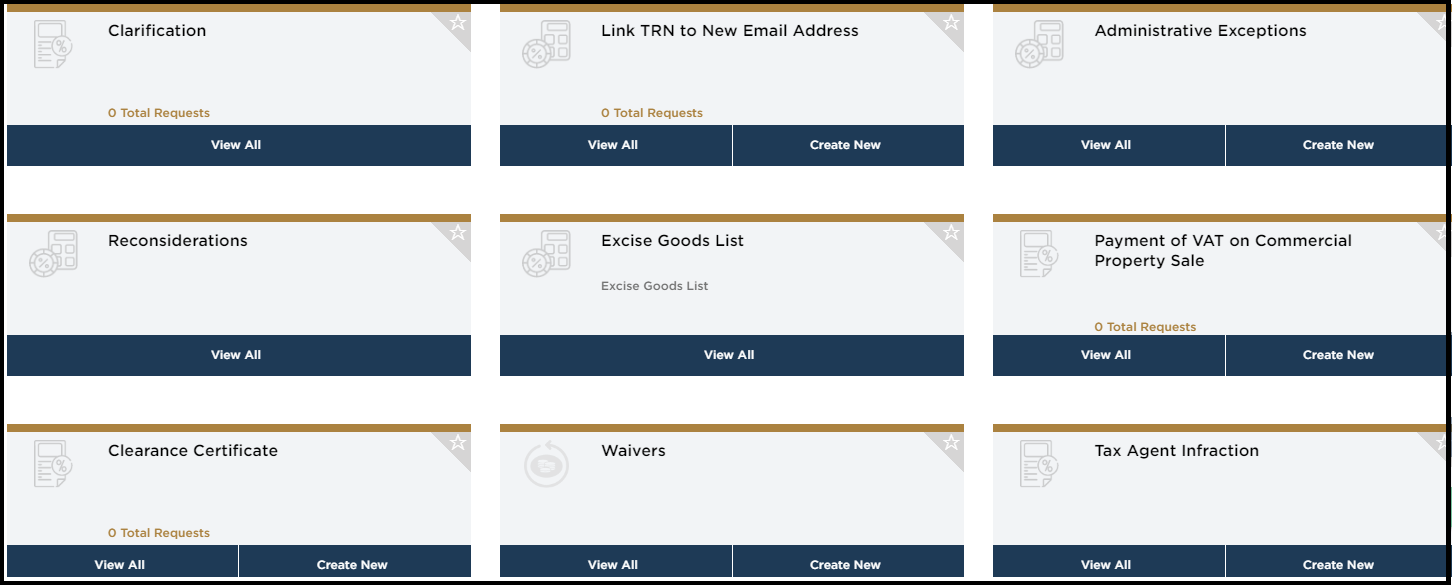

Fill out the Form After logging in.

After the FTA login, you see different options available on the site’s dashboard. Choose your category accordingly. Fill out your form accordingly and become a tax payer. All options given here may change as the website content changes over time. You will not charge any fee for paying tax on the FTA website. Every section has a detailed video that shows you how to input information correctly. After submitting the form, you can also download your tax receipt as a tax-payer certificate.

UAE-Pass and the EmaraTax Portal

FTA has announced that signup and login on the portal will be available only through UAE Pass w.e.f. September 30, 2024. Hence, all existing EmaraTax users are to link their UAE Pass with their accounts. The guidelines for registering and logging in with the UAE Pass provided by the government are here. Click Here

In order to activate their UAE Pass, UAE citizens and residents would have to register based on their Emirates ID on the UAE Pass app, whereas non-residents would have to upload their passports. Once the UAE Pass is activated, it can be used to create a new EmaraTax account or link it with an existing user.

The user is registered on the EmaraTax portal, and the registered email matches the UAE Pass email:

- Go to the EmaraTax homepage and select “Login with UAE Pass.“

- Enter your Emirates ID, email, or phone number associated with UAE Pass.

- Confirm the authentication notification received on the UAE Pass mobile app.

The user is registered on the EmaraTax portal, but the registered email does not match the UAE Pass email:

- Go to the EmaraTax homepage and select “Login with UAE Pass.”

- Enter your Emirates ID, email, or phone number associated with UAE Pass.

- Confirm the authentication notification received on the UAE Pass mobile app.

- On the “UAE PASS: EmaraTax profile linking” webpage, click ‘Yes’ to the question, “Do you have an online account with EmaraTax?”

- Enter your EmaraTax-registered email.

- Confirm the UAE Pass email ID by entering the OTP received on your EmaraTax-registered email.